Nobody is asking for an apology.

What we want is you to STFU with the "up hill both ways" bullshit when it's clear from hindsight you lived through the easiest macroeconomic conditions (post ww2, pre-globalization, etc) ever even if there was a small bump or too.

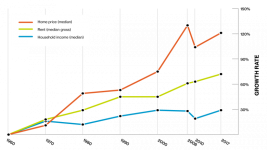

Do the class a favor and express that mortgage payment as a % of monthly income.

Then compare to today.

I'm not a victim. I've got a house and investments because I prioritized that shit. I'm not hard up for money.

Everyone my age and younger who didn't work super hard to make that shit happen fast is pretty fucked though. Sure they'll buy houses and start businesses eventually but they will be a couple rungs poorer at every single point in their life because of dumb economic (and foreign) policy made by people 30-50yr older than them.

Boomer is a state of mind.

at the boomers who say high interest isn't a bad thing when they bought houses that cost a fraction of what they go for today.

at the boomers who say high interest isn't a bad thing when they bought houses that cost a fraction of what they go for today.

. Try using actual info from the thread so it at least sounds somewhat realistic.

. Try using actual info from the thread so it at least sounds somewhat realistic.