They start showing up like that to collect back taxes and I can assure you that it will not end well for them. The public will not tolerate that shit....

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

87,000 irs agents

- Thread starter jeeptj19992001

- Start date

Thefishguy77

Part time dumbass

Thats what they are hoping for. Been trying to start it for decades now. The Right just wont take the bait.They start showing up like that to collect back taxes and I can assure you that it will not end well for them. The public will not tolerate that shit....

MChat

Resident "Preacher Man"

Wonder if the 87,000 agents are going to start looking for income from "illegal activities"

Here4memes

New member

- Joined

- Apr 13, 2021

- Member Number

- 3774

- Messages

- 3

I didn't go back and scan the entire thread but it appears it fits back into the conversation at this point...

Ya'll are aware the IRS invested $700k in ammo right before the 87k employee hire right?

nypost.com

nypost.com

Ya'll are aware the IRS invested $700k in ammo right before the 87k employee hire right?

GOP wants answers on IRS’ $700K ammo stockpile as Dems OK $80B for agency enforcement

Congressional Republicans want to know what the Internal Revenue Service intends to do with $700,000 worth of ammunition it added to its stockpile.

plym49.2

Sasquatch49.2

- Joined

- May 20, 2020

- Member Number

- 550

- Messages

- 405

Income should not be taxed for individuals, businesses, or corporations.

Tax consumption. The more you consume, the more you pay. Carve out basic necessities like utilities and foundational foods (dairy, grain, rice).

No need for the IRS at all then. Bake it into the sales tax that is already automatically included by each seller.

Cash or cashless transactions? Big fat hairy deal. We've been doing just fine despite tens of thousand of pages of tax code and IRS employees - just eliminating that expense will be a huge recurring upside.

Tax consumption. The more you consume, the more you pay. Carve out basic necessities like utilities and foundational foods (dairy, grain, rice).

No need for the IRS at all then. Bake it into the sales tax that is already automatically included by each seller.

Cash or cashless transactions? Big fat hairy deal. We've been doing just fine despite tens of thousand of pages of tax code and IRS employees - just eliminating that expense will be a huge recurring upside.

CDA 455 II

ANFAQUE2

Boa550

Well-known member

- Joined

- Jun 15, 2020

- Member Number

- 2015

- Messages

- 49

While I agree, in any other time in history they were 'Commissars'. To many people are looking for the 'sexier' 1930's Germany references, but in doing so they fail to realize they are already 5 steps into recreating 1910's Russian Revolution and eventually the Holodomor. The upper/lower middle class have more in common with 1910 White Russians than 1930's Germans. And it's the 21st century, I don't see anyone herded into cattle cars. More likely C-17's that will just go nose up about 500 miles from the coast over the ocean. Rinse, repeat.Must you forget whose bill it is: The Democrats' bill

I don't think it's about money; I think it's a 'Mar-A-Lago'' for the vast majority of the country.

A socialist/communist anal exam for the majority of the population.

THIS IS 1000% ABOUT POWER AND CONTROL over the population.

Hence; why I used the term 'Brown Shirts'.

Taxes?

This has nothing to do with taxes, you silly people.

The deep state wants it's own private military, and this is how they will get it. Taxes is no different than "I think I smell weed" as an excuse they can use to target anyone for anything because the most obscure little tax detail can be used as justification of "I smell weed".

Isn't this exactly what Obama wanted years ago?

CDA 455 II

ANFAQUE2

Sounds like you somewhat know your history.While I agree, in any other time in history they were 'Commissars'. To many people are looking for the 'sexier' 1930's Germany references, but in doing so they fail to realize they are already 5 steps into recreating 1910's Russian Revolution and eventually the Holodomor. The upper/lower middle class have more in common with 1910 White Russians than 1930's Germans. And it's the 21st century, I don't see anyone herded into cattle cars. More likely C-17's that will just go nose up about 500 miles from the coast over the ocean. Rinse, repeat.

However; it appears you're getting the black shirts confused with the brown shirts.

The brown shirts came first during early/mid '30s, enforcing Hi.tler's will against his political opponents and the Ger.man people.

The black shirts came later, completely replacing said brown shirts (some involving execution), after Hi.tler solidified his power.

The Democrat Party are currently in the brown shirt phase; as I posted.

nbjeeptj

Well-known member

- Joined

- Jun 3, 2020

- Member Number

- 1801

- Messages

- 45

If they are only going to audit tax returns of over 400k per year that means each of the 87000 agents will only have 32 tax returns to review and they will cover everyone over 400k. The info is from 2019, but in 2019 there was only 2.8 million tax returns of household income over 400K. Divide 2.8 mil by 87000 agents and its only 32. I would assume if this info is correct, and if you are lucky enough to make over 400k, plan to spend at least a week with a IRS agent.

CDA 455 II

ANFAQUE2

It's the opposite.If they are only going to audit tax returns of over 400k per year that means each of the 87000 agents will only have 32 tax returns to review and they will cover everyone over 400k. The info is from 2019, but in 2019 there was only 2.8 million tax returns of household income over 400K. Divide 2.8 mil by 87000 agents and its only 32. I would assume if this info is correct, and if you are lucky enough to make over 400k, plan to spend at least a week with a IRS agent.

They're going after the bottom 50% of the tax bracket.

The Democrats are basically DOUBLING the size of the IRS with the 87,000 new-hires.

bigun

Red Skull Member

4 Facts About IRS Gun Arsenal - AMAC - The Association of Mature American Citizens

the Inflation Reduction Act, which, among other things, would double the size of the IRS with 87,000 new agents to beef up enforcement.

amac.us

amac.us

4 Facts About IRS Gun Arsenal

Posted Monday, August 15, 2022 | By Outside ContributorSome of the 87,000 new agents whom Democrats propose to hire at the Internal Revenue Service could come with some extra firepower.

On Friday, House Democrats gave final passage to the tax and spending bill they dubbed the Inflation Reduction Act, which, among other things, would double the size of the IRS with 87,000 new agents to beef up enforcement.

As of two years ago, the IRS had an arsenal of 4,600 guns, reported OpenTheBooks, a government watchdog group.

Two federal investigations in the past decade found that IRS agents had not been sufficiently trained and were accident-prone with the weapons they have. Armed IRS raids on nonviolent taxpayers surfaced as a concern almost 25 years ago during a Senate hearing.

Democrats’ bill, which the Senate passed Sunday, awaits the signature of President Joe Biden should it clear the House as early as Friday.

The legislation, which unwinds from 2023 through 2031, would devote $80 billion to expanding the IRS and boosting tax revenue to pay for Democrats’ green energy subsidies and other pet projects.

Americans for Tax Reform, a conservative group that opposes the legislation, assembled information about the IRS arsenal from government and media reports.

During the House floor debate Friday, Rep. Lauren Boebert, R-Colo., raised concerns about arming IRS agents.

“This bill has new IRS agents and they are armed, and the job description tells them that they need to be required to carry a firearm and expect to use deadly force if necessary,” Boebert said. “Excessive taxation is theft. You are using the power of the federal government for armed robbery on the taxpayers.”

Rep. John Yarmuth, D-Ky., suggested that no IRS agents are armed.

“The idea that they are armed—I know that Ms. Boebert would like everybody to be armed, but that’s not what IRS agents do,” Yarmuth said. “I would implore my Republican colleagues to cut out the scare tactics. Quit making things up.”

In a posted job opening for a special agent, the IRS specified that applicants should be “willing and able to participate in arrests, execution of search warrants, and other dangerous assignments,” and able to carry “a firearm and be willing to use deadly force, if necessary.”

After sparking some controversy amid the proposed expansion of the agency, the IRS deleted “willing to use deadly force” from the job description.

The IRS referred questions to the Treasury Department as to whether the arsenal would increase as the number of personnel multiplies.The IRS is hiring new special agents!

Requirements include working min “50 hours per week, which may include irregular hours, and be on-call 24/7, including holidays and weekends” and “Carry a firearm and be willing to use deadly force, if necessary.”https://t.co/uvwbrAkIit pic.twitter.com/z0aVX6uoMr

— Ford Fischer (@FordFischer) August 10, 2022

The Treasury Department did not immediately respond to The Daily Signal’s request for comment for this report.

Here are four key things to know about the Internal Revenue Service and weapons.

1. IRS Guns and Ammo

The current IRS workforce includes 78,661 full-time employees, so Democrats’ legislation, if passed as written, would more than double the agency’s employees.A 2020 report from OpenTheBooks, titled “The Militarization of the U.S. Executive Agencies,” shows that the IRS Criminal Investigation division has a stockpile of 4,600 guns.

The firearms include 3,282 pistols, 621 shotguns, 539 rifles, 15 fully automatic firearms, and four revolvers, the report says.

The Government Accountability Office, a federal watchdog agency, reported in 2018 that the IRS had 3.1 million rounds of ammunition for pistols and revolvers.

The tax agency had 1.4 million rounds of ammunition for rifles, the GAO report said, along with 367,750 shotgun rounds and 56,000 rounds for automatic weapons.

2. Armed Agents ‘Not Properly Trained’

The IRS’s National Criminal Investigation Training Academy has the responsibility to implement firearms training and a related qualification program nationwide.However, IRS agents assigned to the Criminal Investigation division regularly failed to stay up to date with training or to report incidents of improper firearms use, according to a 2018 report from the Treasury Department’s inspector general for tax administration.

The inspector general’s report notes that “there is no national level review of firearms training records to ensure that all special agents meet the qualification requirements.”

“Special agents not properly trained in the use of firearms could endanger the public, as well as their fellow special agents, and expose the IRS to possible litigation over injuries or for damages,” the report says.

For qualification, each agent must score 75% or higher on the firing range, but the IRS lacked documentation showing its agents met the standards, according to the inspector general.

The report says that 79 of the 459 special agents in the agency’s long gun cadre failed to meet standard qualification requirements. Further, the report says the IRS could not provide information about whether 1,500 special agents were trained in tactical equipment proficiency.

In fiscal year 2016, the inspector general’s report determined, the IRS Criminal Investigation division “did not maintain documented evidence that 145 out of 2,126 special agents met the firearm standards established by CI [Criminal Investigation] and therefore were not qualified law enforcement officers.”

3. More Unintended Discharges Than Intended Ones

The poor firearms training for IRS agents has led to more accidental firings than intentional firings, according to a separate inspector general’s report from 2012.“Having the availability of deadly force puts hiring so many new agents into perspective,” Grover Norquist, president of Americans for Tax Reform, told The Daily Signal.

The inspector general for tax administration “found they fired their guns more times by accident than on purpose,” Norquist said. “I’m not sure if that’s good or bad.”

The poor training was not a new problem, since the 2012 report from the inspector general found similar issues with firearms training.

“If there is insufficient oversight, special agents in possession of firearms who are not properly trained and qualified could endanger other special agents and the public,” the report says.

The 2012 report not only found that IRS agents fired their weapons by accident more times than intentionally, but that the agency concealed details about the accidental discharges.

“There were a total of eight firearm discharges classified as intentional use of force incidents and 11 discharges classified as accidental during FYs 2009 through 2011,” the report says.

And, the inspector general’s report continues, “we found that four accidental discharges were not properly reported.”

It says that “the accidental discharges may have resulted in property damage or personal injury.”

The public report, however, redacts four references to unreported accidental discharges of firearms.

bigun

Red Skull Member

4. IRS History of Armed Raids

In 1998, the Senate Finance Committee held investigative hearings into IRS abuses that featured testimony from a Virginia restaurant owner.The restaurant owner said that armed IRS agents with drug-sniffing dogs burst into his restaurant during breakfast hours and ordered customers to get out.

Agents took his cash register and records, the restaurant owner told the Senate committee. When he returned home, he found that his door had been kicked open and his residence had been raided.

A tax preparer from Oklahoma gave similar testimony, saying that about 15 armed IRS agents came to his business and harassed his clients.

The owner of a Texas oil company recounted that agents came to his office and told employees: “Remove your hands from the keyboards and back away from the computers. And remember, we’re armed!”

In each case, the agents came up empty-handed.

The Washington Post reported at the time that Democrat and Republican lawmakers alike expressed dismay, and that the Clinton administration’s IRS commissioner, Charles O. Rossotti, promised an investigation of such actions.

At a separate hearing that year before the same Senate committee, Treasury Department’s inspector general, Harry G. Patsalides, told senators that the IRS had tolerated car thefts and anonymous bullying by promoting an agent accused of sexual harassment and allowing agents to conduct armed raids on nonviolent taxpayers.

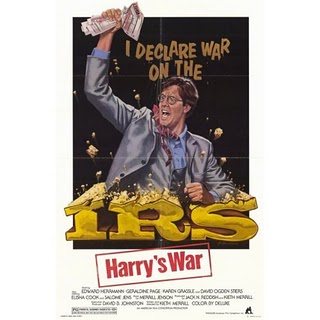

Harry's War (1981 film) - Wikipedia

en.wikipedia.org

en.wikipedia.org

Plot[edit]

After his aunt dies of a heart attack while fighting the US Internal Revenue Service (IRS), Harry Johnson decides to take up the cause in what may seem to be an unconventional manner: he declares war on the IRS. After the funeral of Harry's aunt, Harry uses a Half-track to sabotage a television interview of his IRS nemesis. Several violent outcomes occur with some anti-government (or, at least, anti-IRS) rhetoric.Yota Up

Dull man

- Joined

- May 20, 2020

- Member Number

- 648

- Messages

- 1,607

Step 1: Suspicion.

Step 2: Confirmation via fact checkers stating opposite of suspicion.

You don't even have to think these days. Just wait for fact checkers to say it ain't so and now you know it IS so.

factcheck.afp.com

factcheck.afp.com

Step 2: Confirmation via fact checkers stating opposite of suspicion.

You don't even have to think these days. Just wait for fact checkers to say it ain't so and now you know it IS so.

Claims of 'IRS army' targeting US taxpayers are misleading

Social media posts and conservative politicians claim sweeping economic legislation provides for a new "army" of 87,000 Internal Revenue Service (IRS) auditors to target all US taxpayers -- creating an agency larger than the Pentagon, State Department, Border Patrol and FBI combined. This is...

Yota Up

Dull man

- Joined

- May 20, 2020

- Member Number

- 648

- Messages

- 1,607

Real pictures. Not a joke.

These immature liberals are going to be the future of this private commie army.

Gotta love the smile on the face of the guy pretending to shoot an old man in the back, huh?

For years, IRS Criminal Investigation field offices have brought the Adrian Project to college and university campuses nationwide. How does it work? Classes participate in a day-long simulation of a mock criminal investigation. The goal is to provide students with a firsthand look at what it's like for IRS special agents to carry out an investigation, tracking illicit money from the crime to the criminal.

Students are "sworn in" as special agents in the morning and wear IRS protective vests, use handcuffs, toy guns and radios to communicate with their counterpart agents on the case. The students sharpen their forensic accounting skills and are introduced to interviewing suspects, conducting surveillance and document analysis. The day ends when the students solve the crime and arrest the mock offender.

The Adrian Project provides students a glimpse into the career life of an IRS special agent and what a criminal investigation entails.

www.irs.gov

www.irs.gov

These immature liberals are going to be the future of this private commie army.

Gotta love the smile on the face of the guy pretending to shoot an old man in the back, huh?

Adrian Project allows students to become IRS Criminal Investigation special agents for a day

If you think all accountants sit at a desk all day, IRS Criminal Investigation special agents will prove you wrong.For years, IRS Criminal Investigation field offices have brought the Adrian Project to college and university campuses nationwide. How does it work? Classes participate in a day-long simulation of a mock criminal investigation. The goal is to provide students with a firsthand look at what it's like for IRS special agents to carry out an investigation, tracking illicit money from the crime to the criminal.

Students are "sworn in" as special agents in the morning and wear IRS protective vests, use handcuffs, toy guns and radios to communicate with their counterpart agents on the case. The students sharpen their forensic accounting skills and are introduced to interviewing suspects, conducting surveillance and document analysis. The day ends when the students solve the crime and arrest the mock offender.

The Adrian Project provides students a glimpse into the career life of an IRS special agent and what a criminal investigation entails.

Adrian Project allows students to become IRS Criminal Investigation special agents for a day | Internal Revenue Service

If you think all accountants sit at a desk all day, IRS Criminal Investigation special agents will prove you wrong.

bigun

Red Skull Member

Anybody else remember Obama wanting a civilian army?

CDA 455 II

ANFAQUE2

Anybody else remember Obama wanting a civilian army?

Obama used the IRS extensively to target political opponents and conservative groups.

DirtRoads

Uninformed

It's the opposite.

They're going after the bottom 50% of the tax bracket.

The Democrats are basically DOUBLING the size of the IRS with the 87,000 new-hires.

Alabamas football stadium holds about 101k.

They’re almost going to fill that fucking thing up with new hires.

woods

I probably did it wrong.

- Joined

- May 22, 2020

- Member Number

- 1120

- Messages

- 5,165

Not for nothing, but are there that many people trained/educated/??? to become IRS agents? Almost seems like there's that many political science majors serving fast food.Alabamas football stadium holds about 101k.

They’re almost going to fill that fucking thing up with new hires.

rugger

TheOrginalMiataGuy

the conservative atheist

😷😷😷ㅤ=ㅤ🐑🐑🐑

- Joined

- Jun 3, 2020

- Member Number

- 1809

- Messages

- 653

Step 1: Suspicion.

Step 2: Confirmation via fact checkers stating opposite of suspicion.

You don't even have to think these days. Just wait for fact checkers to say it ain't so and now you know it IS so.

"Fact checking" became a useless laughingstock when the "facts" said taking the COVID vaccine would protect other people around you.

rugger

TheOrginalMiataGuy

Love all those shitty movie grips, too.Can those idiots even spell IRS?

Landslide

Red Skull Member

- Joined

- May 20, 2020

- Member Number

- 422

- Messages

- 1,432

IRS Official Nikole Flax Who Was Involved in the IRS Conservative Targeting Scandal — Is Picked to Lead the “Centralized Office” for the New 87,000 Employees

IRS Official Nikole Flax Who Was Involved in the IRS Conservative Targeting Scandal -- Is Picked to Lead the "Centralized Office" for the New 87,000 Employees

bigun

Red Skull Member

The end of Harry's War

Motorcharge

Unregistered User

I'm really hoping they try to send a dude in a wheelchair to my place.

78bronco460

Well-known member

- Joined

- May 23, 2020

- Member Number

- 1272

- Messages

- 450

Not so fast…

McCarthey just said the first bill they’re gonna pass will repeal the funding for the 87k agents. Nice kickoff.

McCarthey just said the first bill they’re gonna pass will repeal the funding for the 87k agents. Nice kickoff.