Provience

Kill!

The 2023 Stock Market Thread

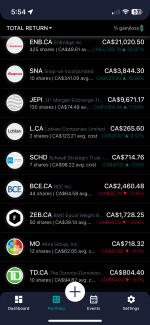

Check your calendars damnit, it ain't 22 anymore! :flipoff2: I'm happy with my RY stocks on the TSX. Still planning to keep for another 20 years.

continuation of the above for the new year

Started off by taking my chastizing to heart from the end of the last thread. Closed my 2 USB call options expiring ~2 weeks from now for ~110% gain, good enough.

my 1 share of COIN hit the trailing stop and sold for $168, i'll happily take my $10 for a week of time

Starting account value $10.2k which is setting me up for some high risk downfall.

Overall, took a while and I didn't get to spend the time that I'd wanted making trades and staying on top of stuff but it worked out.

edit: couldn't keep well enough alone, picked up 100 shares of HFWA with my proceeds. If nothing else, 4.5% dividend. I do believe that being a smaller regional bank means they will trend much more safely with the broad "banking revival" that I am expecting through winter and into spring. So, we'll see what happens there. If it goes up 15% over the next 3 months i'll be happy. far too little volume to be comfortable attempting an option contract

Last edited:

. I don't have time to day trade, so everything is pretty conservative. We should find by the end of Q2 if this is a new bull market or a bear market rally.

. I don't have time to day trade, so everything is pretty conservative. We should find by the end of Q2 if this is a new bull market or a bear market rally.