I'll throw out what I've seen as the leading edge of gen Z. The student loans need to resume. At this point the most affected are the older gen Z and younger millennials. Both of whom are the most capable of moving back home and working the bare minimum hours to afford fake luxuries like door dash, Starbucks, and Netflix instead of being productive. Having them forced back in to the workplace is crucial.

TLDR: People are living longer than ever, slowing down turnover, hurting younger generations far more than in previous generations.

As for what the boomers did, I can find 3 things. I don't blame them for any of them, they just got lucky.

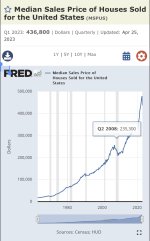

The first thing they did was live longer than the previous generations. This gives them more time to build wealth, more time to hold on to it, and less turnover to the younger generations. Housing in particular is a big issue. My grandfather, in a welcome to the company meeting with other engineering new hires was told that the statistics showed that he would work to 60, and die at 65. He's 80+. Him and my grandmother still live in the same house that their kids graduated high school from.

The second thing they did is live longer suddenly. Had the life expectancy increase a 1-3 years per generation, the first thing would not have been an issue; society would have had time to react and change. Instead it was a 10+year jump, with the wealthier members exceeding that. No time to react. All greatly compounding the slowing down of wealth turnover. I have tried, without success, to find a graph showing the difference in life expectancy at birth vs actual average age of death over the years.

And three, there are a lot of them. They are called the baby boomers for a reason. Anything thing they do they do with an extreme amount of weight, even if its unintentional. If on average they live longer, have more wealth, live in there home longer, it has a massive reach.

Now to throw my own generation under the bus. Social media has screwed our minds up so much. Everyone views it as there shortcut to money. "I'll be the next big streamer." Or "Why work when I can do onlyfans for the little bit of money I need while living with my parents." Or it gives them this false idea of the jobs and lifestyles they can obtain. Anyone see those day in the life of a tech employee videos a few months ago? It seems like every day there is another news story saying "I moved into a traveling house, look how awesome my life is" or "I'm a self made millionaire at 20. Pay to view my social media and I'll show you how." There is the issue of wanting the mid career and early retirement wealth right out of college, and growing up seeing credit cards instead of cash does not help. All while entering into an economy lead by services instead of goods production.

At the same time, there are a lot young white and blue collar people trying to get a start on a life similar to what their parents have. But we run into major blockages. More day to day costs. Internet, phone, etc. High gas and groceries. High prices for over complicated, over regulated vehicles. High prices for entry level houses. Lack of entry level houses. Lack of things like fixer uppers; mid career people are buying anything that's not gutted, doing a cheap renovation, and renting or flipping it. I don't blame them, I would too. And now, with high interest rates, anyone who bought in the last few years is holding. All things that overly affect those trying to get into the system. Those who have been in the system aren't affected when house prices go up $100K because their house also went up $100k. To trade up costs them the same amount as before the price increase.

And to those who say that you don't have to live in the city, that's where most of the jobs are. And most of the livable area and land outside the city has been bought and developed or is not for sale. The couple acre lots 30-40 minutes outside of town are rapidly drying up, and what's left is demanding a premium as those with money leave the crowds. So we get stuck renting or trying to buy into a cramped, expensive area.

So we are stuck waiting for the bubbles to burst. Tech, vehicles, housing, the unproductive jobs. We want the economy to tighten its belt and trim some fat because it is the only way we see a chance to live the lives our parents lived.

) .

) .